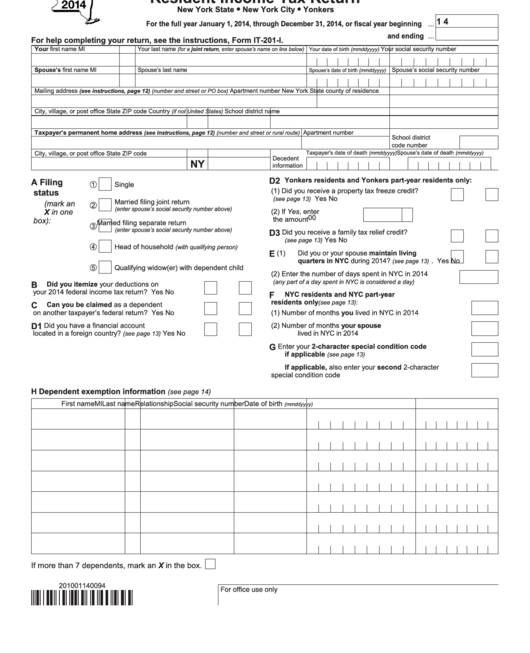

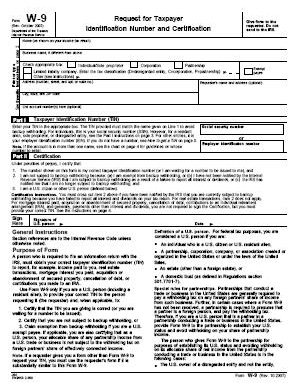

Are you a freelancer or independent contractor looking for tax forms to report your earnings? Whether you need a W9 or 1099 printable form, we’ve got you covered with all the information you need to stay organized and compliant.

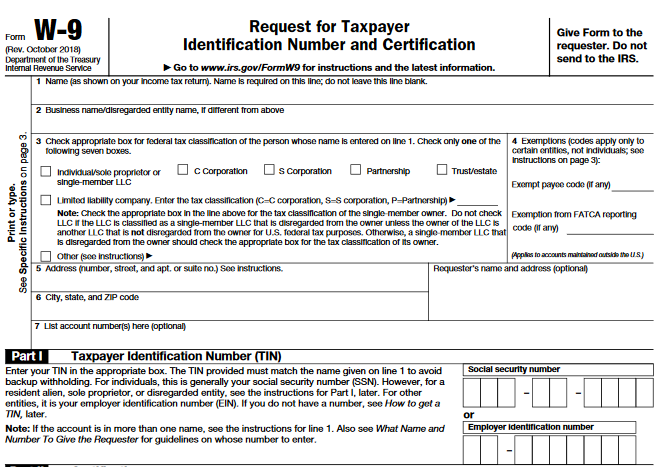

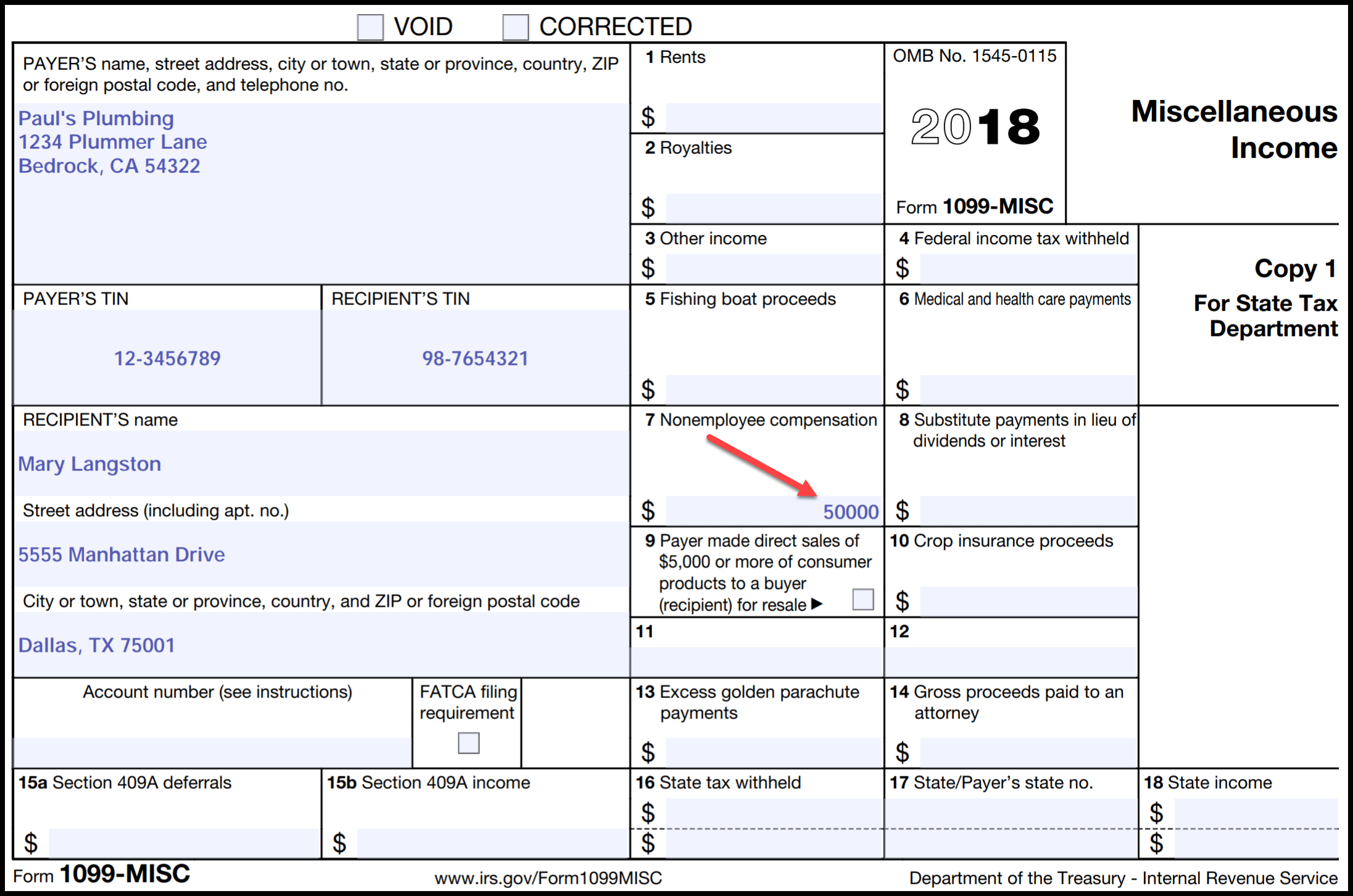

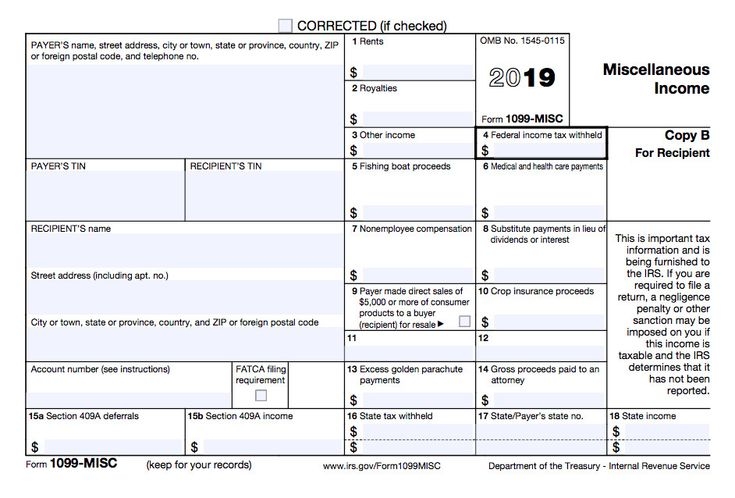

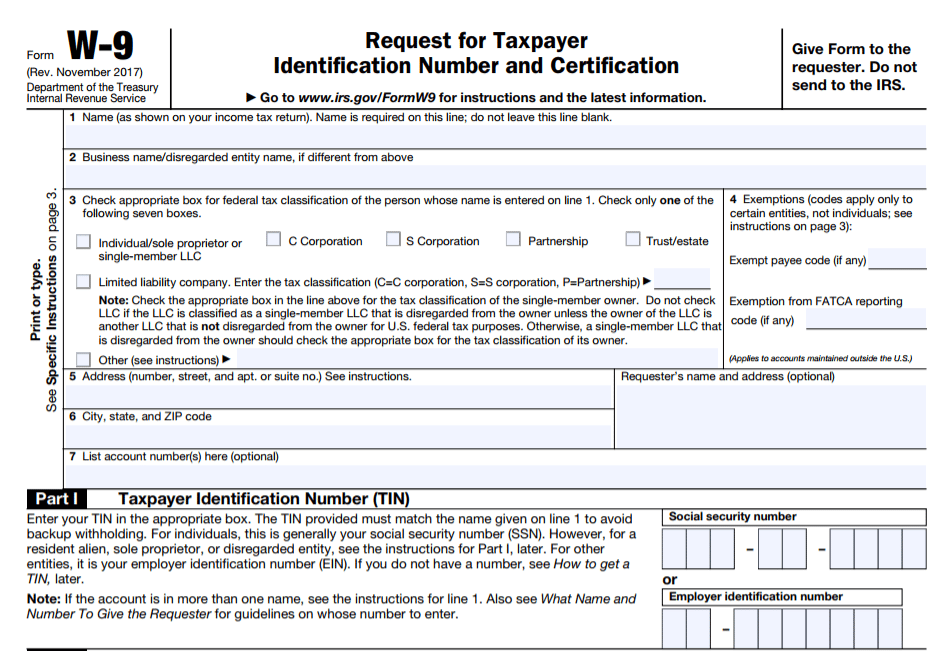

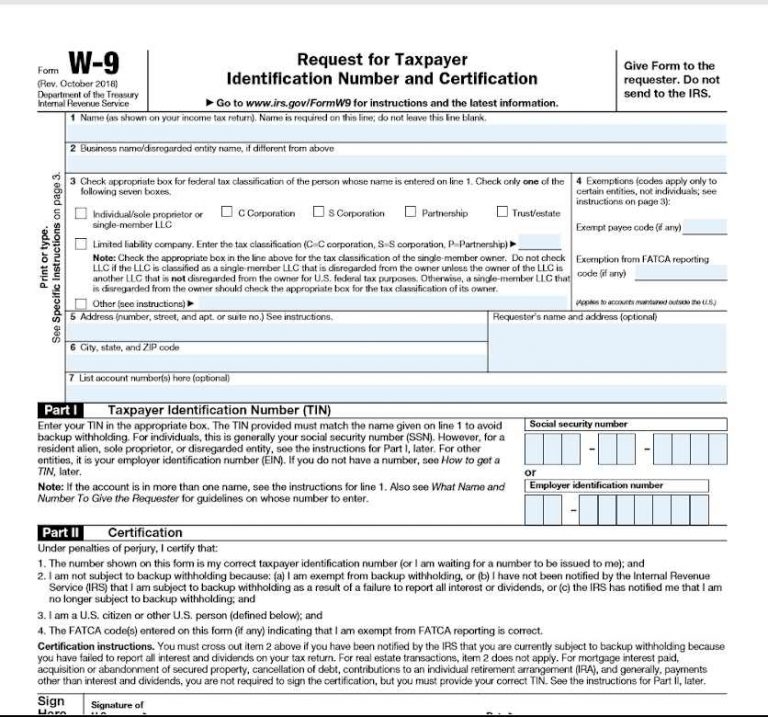

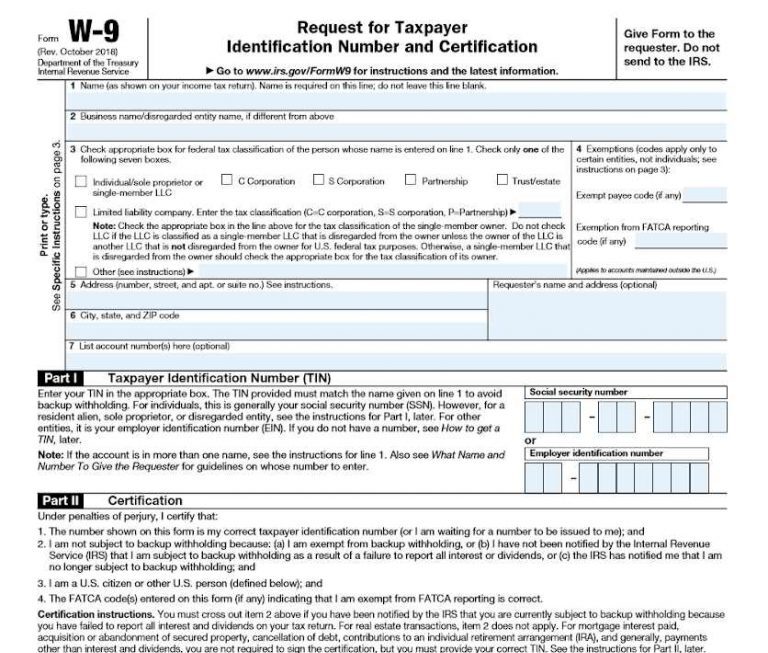

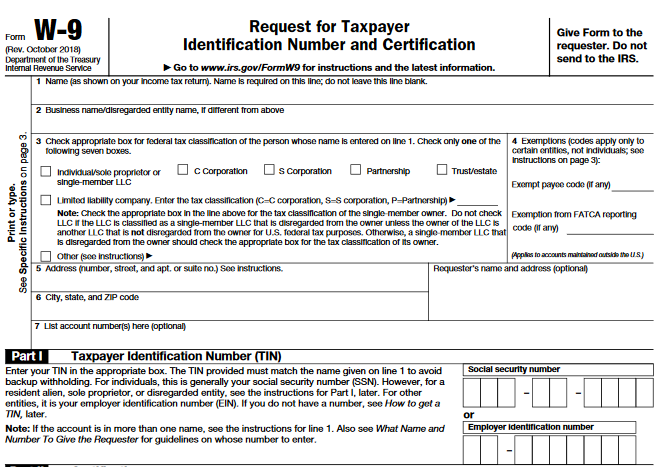

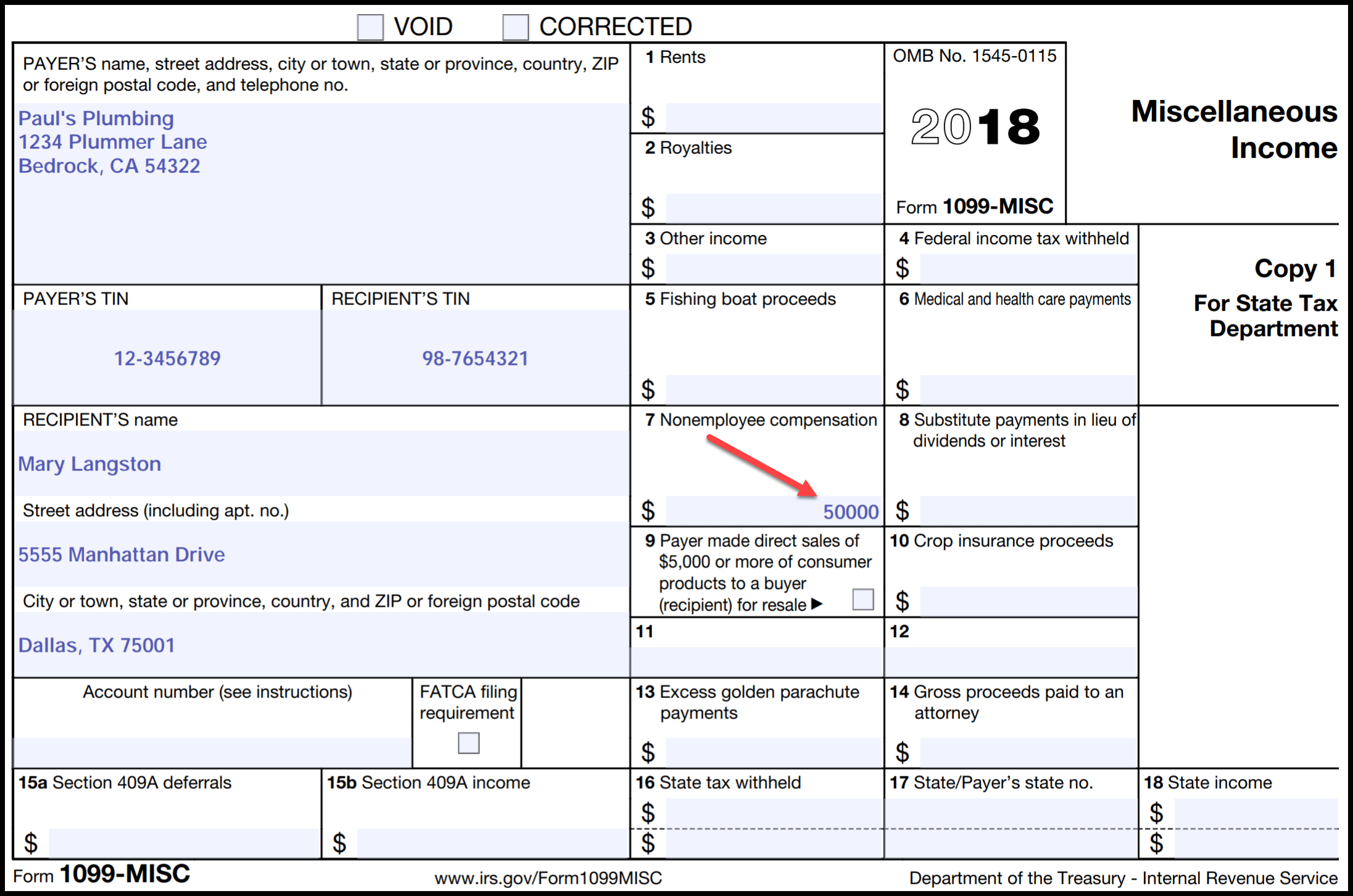

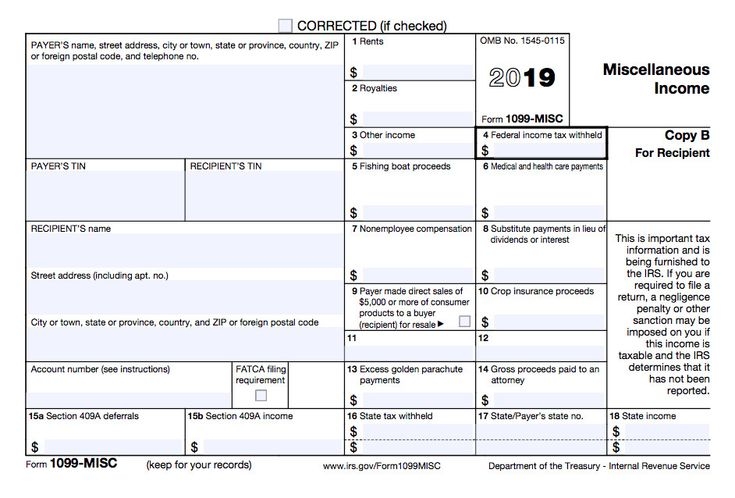

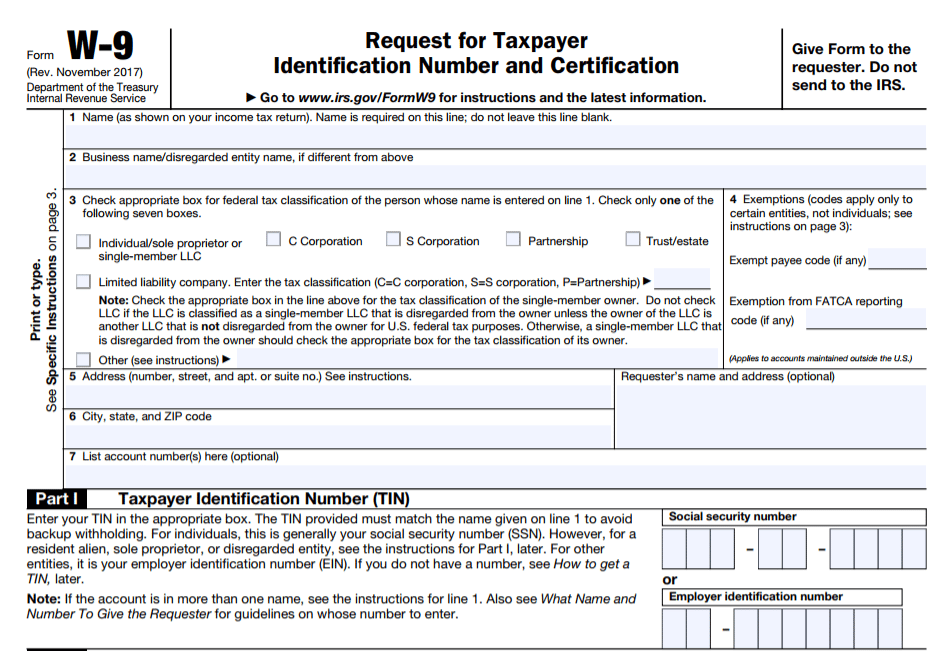

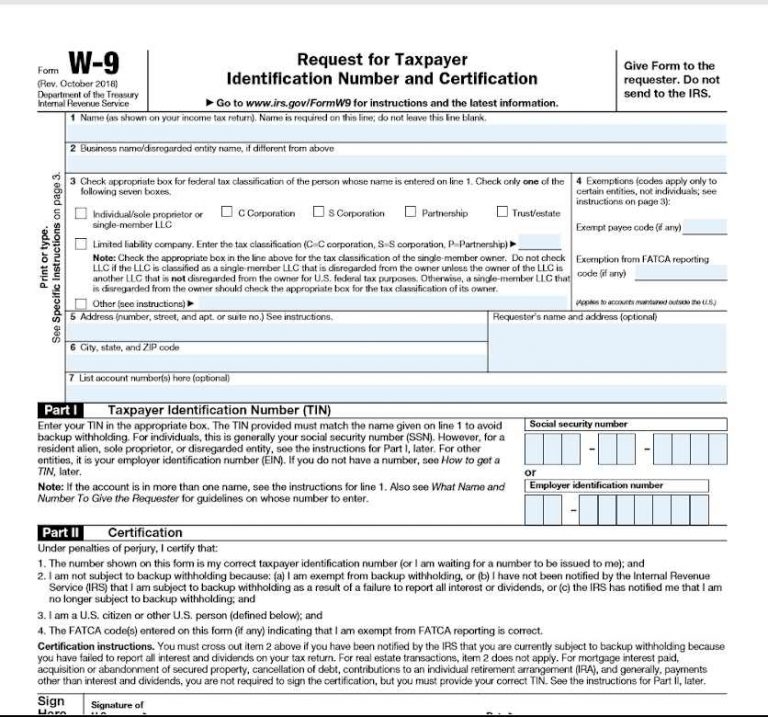

Understanding the difference between a W9 and 1099 form is crucial for tax purposes. A W9 is used by businesses to request taxpayer identification information from independent contractors, while a 1099 is used to report income earned as a contractor or freelancer.

Related Post Printable Blank To Do List With Lines

Make sure to double-check all the information you provide on these forms to avoid any discrepancies or delays in processing. Keep copies of your completed forms for your records and submit them to the appropriate parties as required by law.

By staying organized and proactive with your tax documentation, you can avoid potential issues down the road. Don’t wait until the last minute to gather your forms – take the time to fill them out accurately and on time to ensure a smooth tax filing process.

Whether you’re a seasoned freelancer or new to the gig economy, understanding the importance of W9 and 1099 forms is key to staying compliant with tax regulations. By utilizing printable forms and staying on top of your paperwork, you can navigate tax season with ease and peace of mind.

Get ahead of the game by downloading your W9 and 1099 printable forms today and simplify your tax preparation process. Stay organized, stay compliant, and keep your financial records in order for a stress-free tax season.

Download and Print W9 Or 1099 Printable Form Listed below